FROM OUR BLOG

FROM OUR BLOG

FROM OUR BLOG

ADP Run + CostAllocation Pro

Sep 15, 2024

ADP Run + CostAllocation Pro

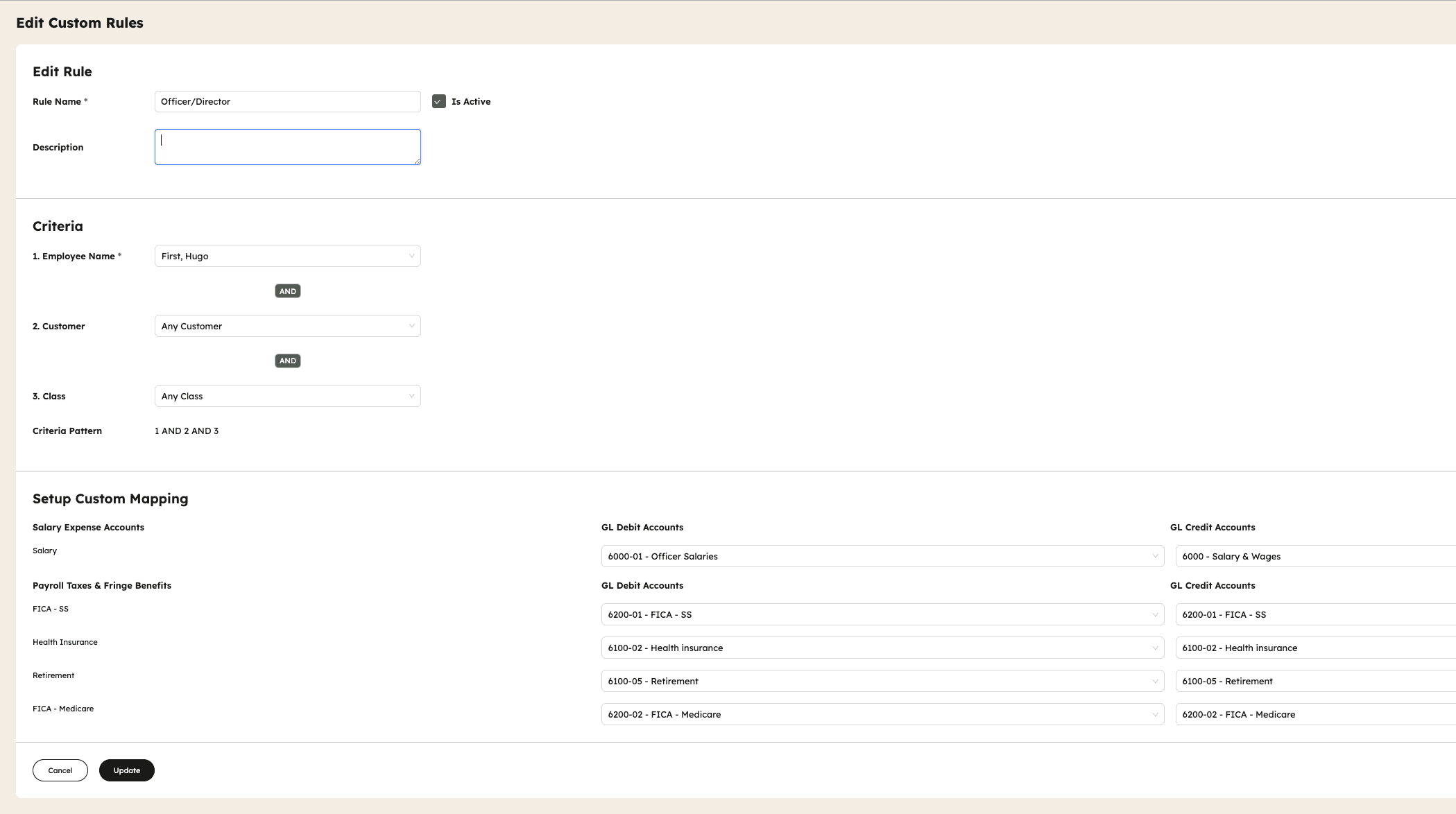

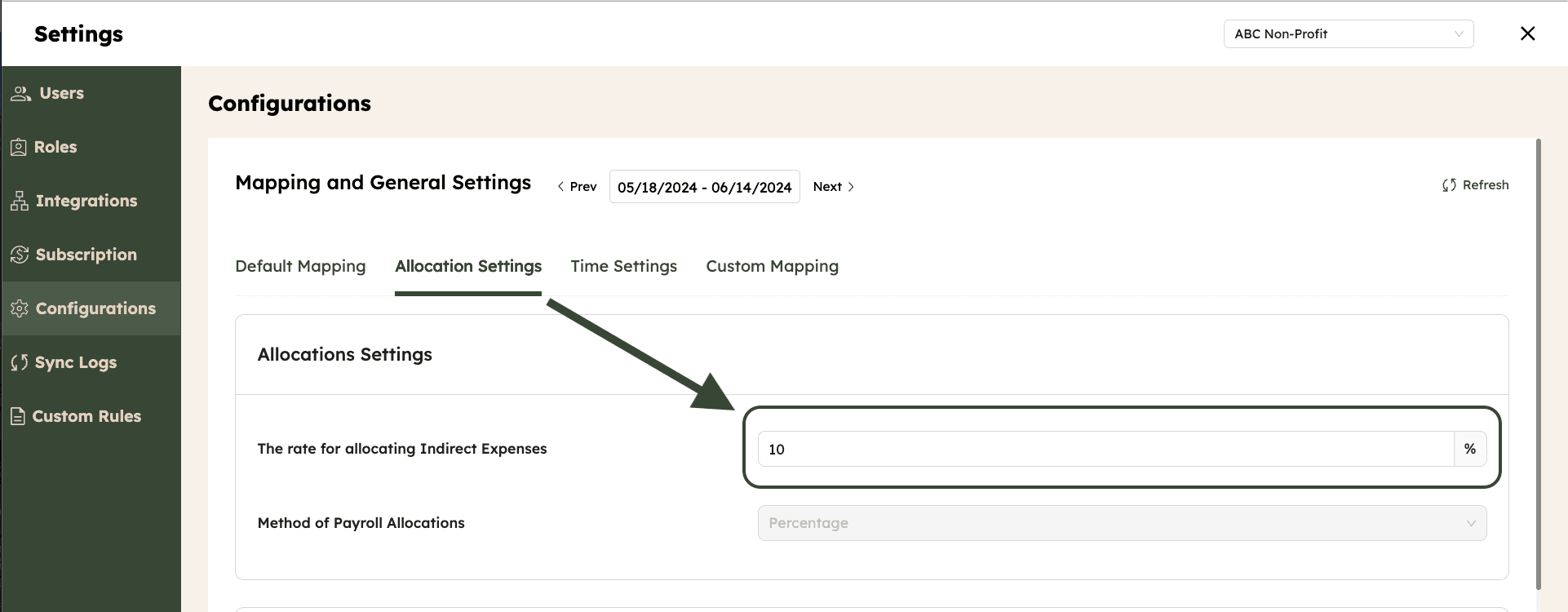

ADP Run + CostAllocation Pro can be a great combination to track and allocate payroll cost by customer/class. These instructions will provide guidance on setting up your ADP Run General Ledger to work best with CostAllocation Pro.

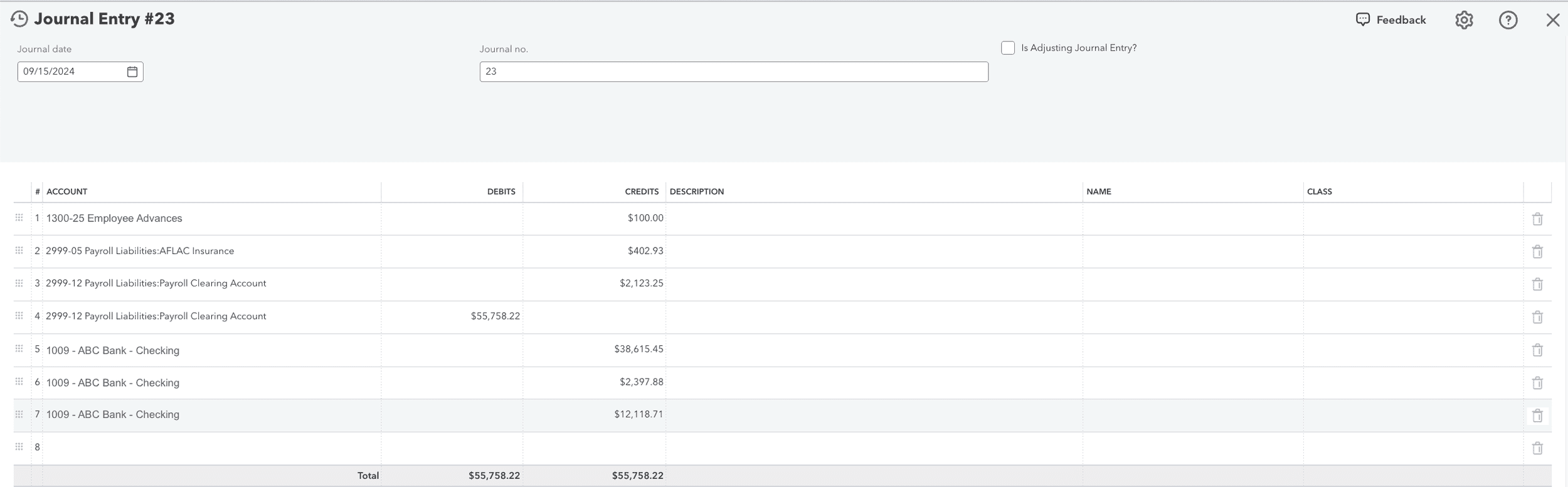

This workflow uses a Payroll Clearing Liability account. The Payroll Clearing Liability account will need to be added to your QBO chart of accounts if you do not already have that account set up.

To properly configure the ADP Run General Ledger:

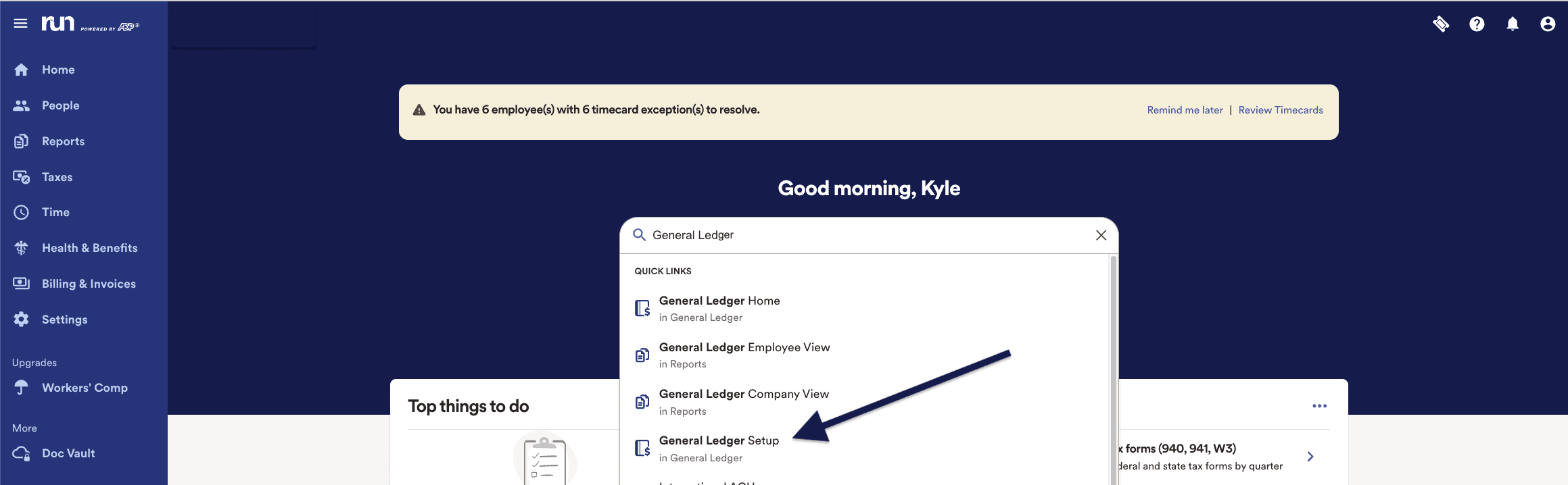

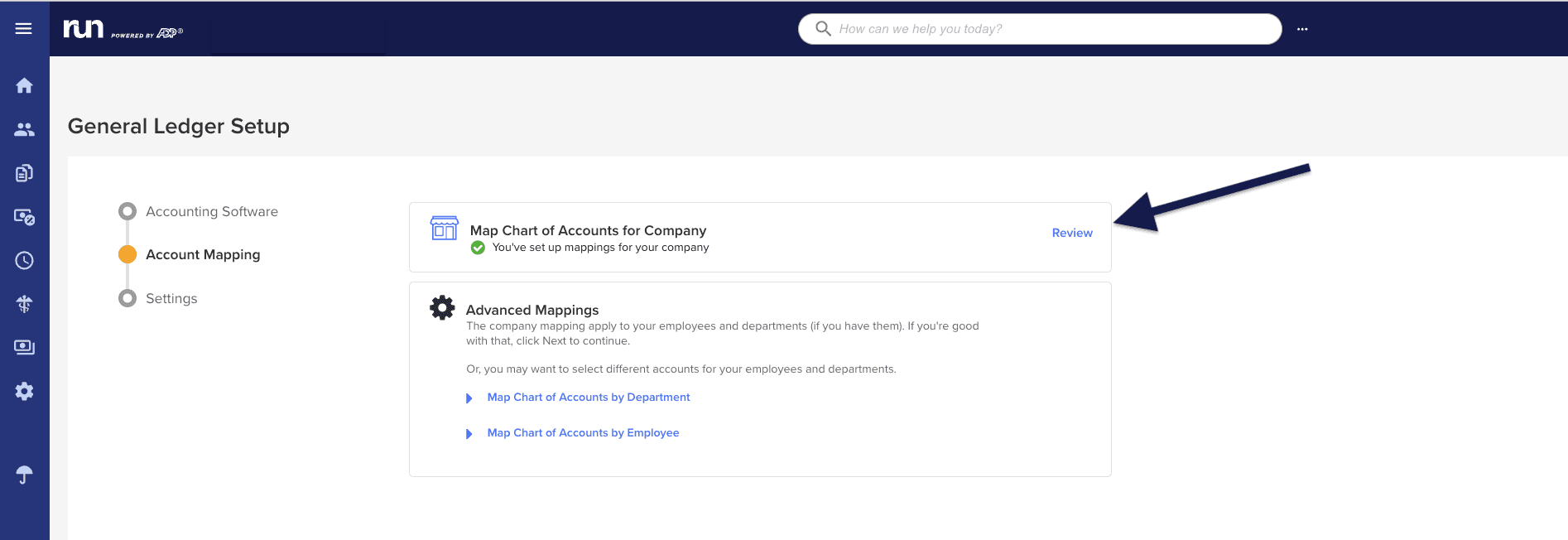

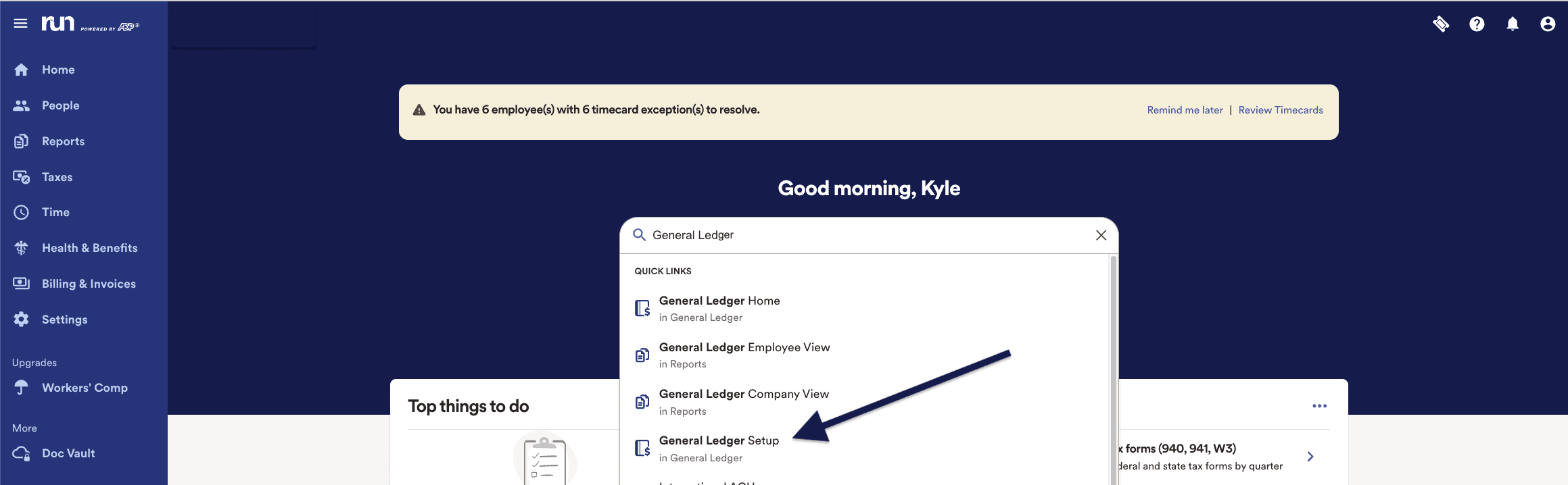

Go to “General Ledger Setup” on ADP Run

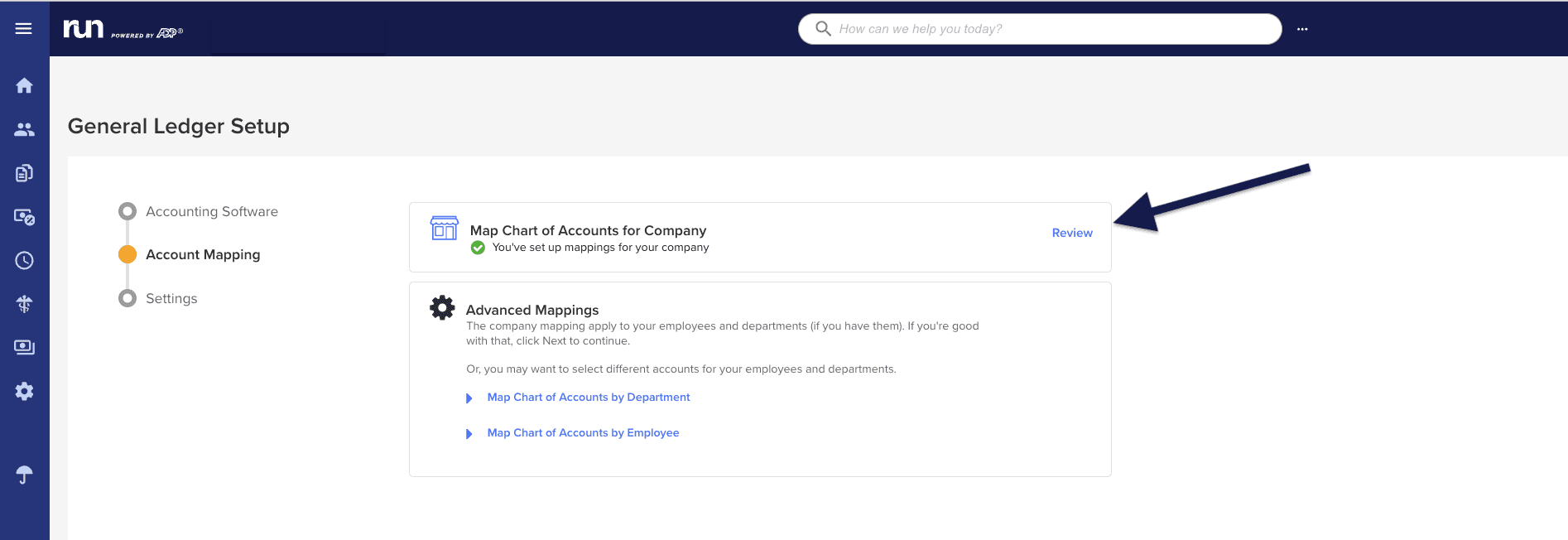

On the “account mapping section” click the “Review” button for the “ Map Chart of Accounts for Company”.

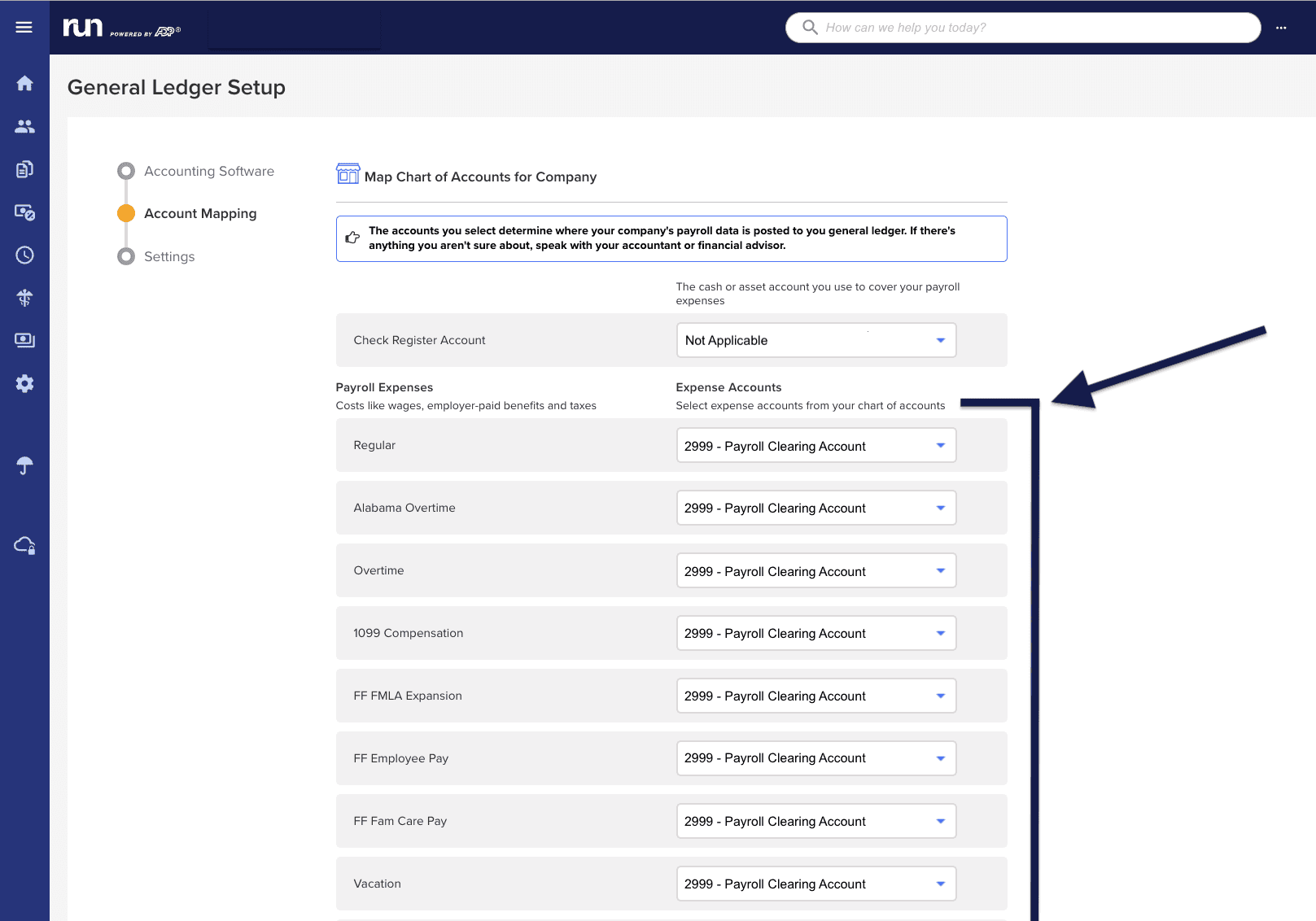

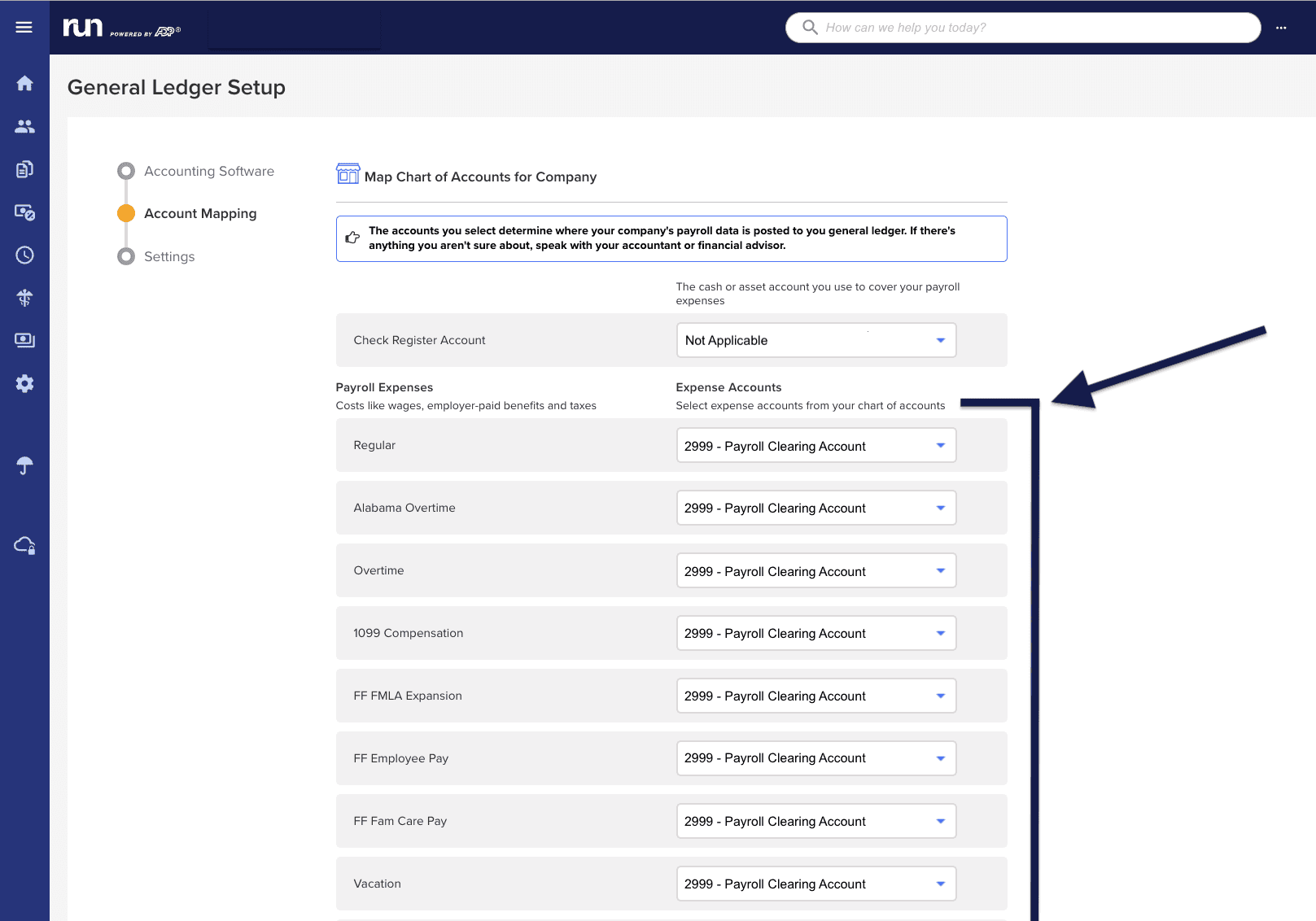

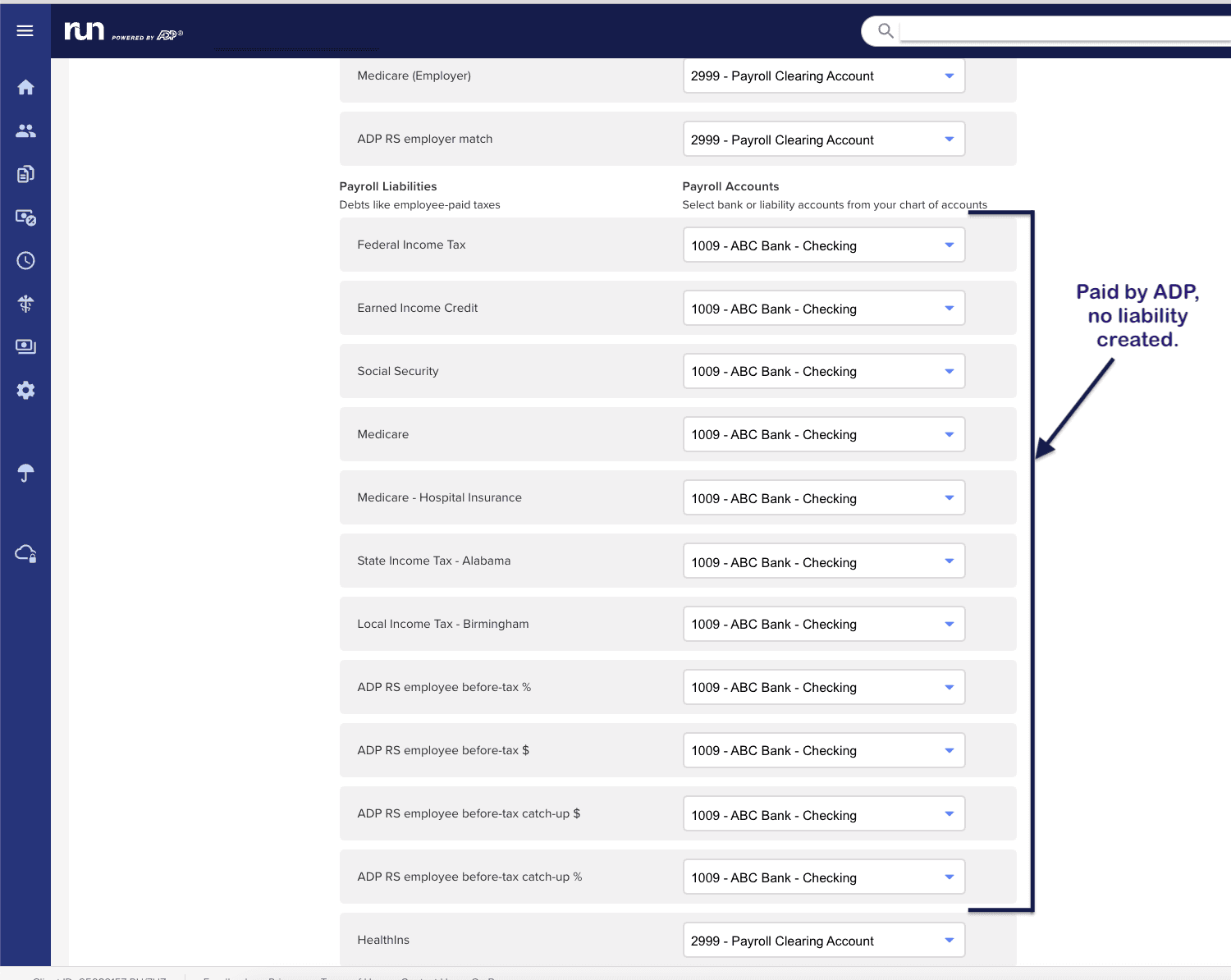

The mapping fields are separated into two main sections, Payroll Expenses and Payroll Liabilities. The Payroll Expenses sections represents the debit side of the journal entries that will be posted by ADP. The Payroll Liabilities section represents the credit side of the payroll entries that will be posted by ADP.

Map all the Payroll Expenses (debits) to the “Payroll Clearing Account”

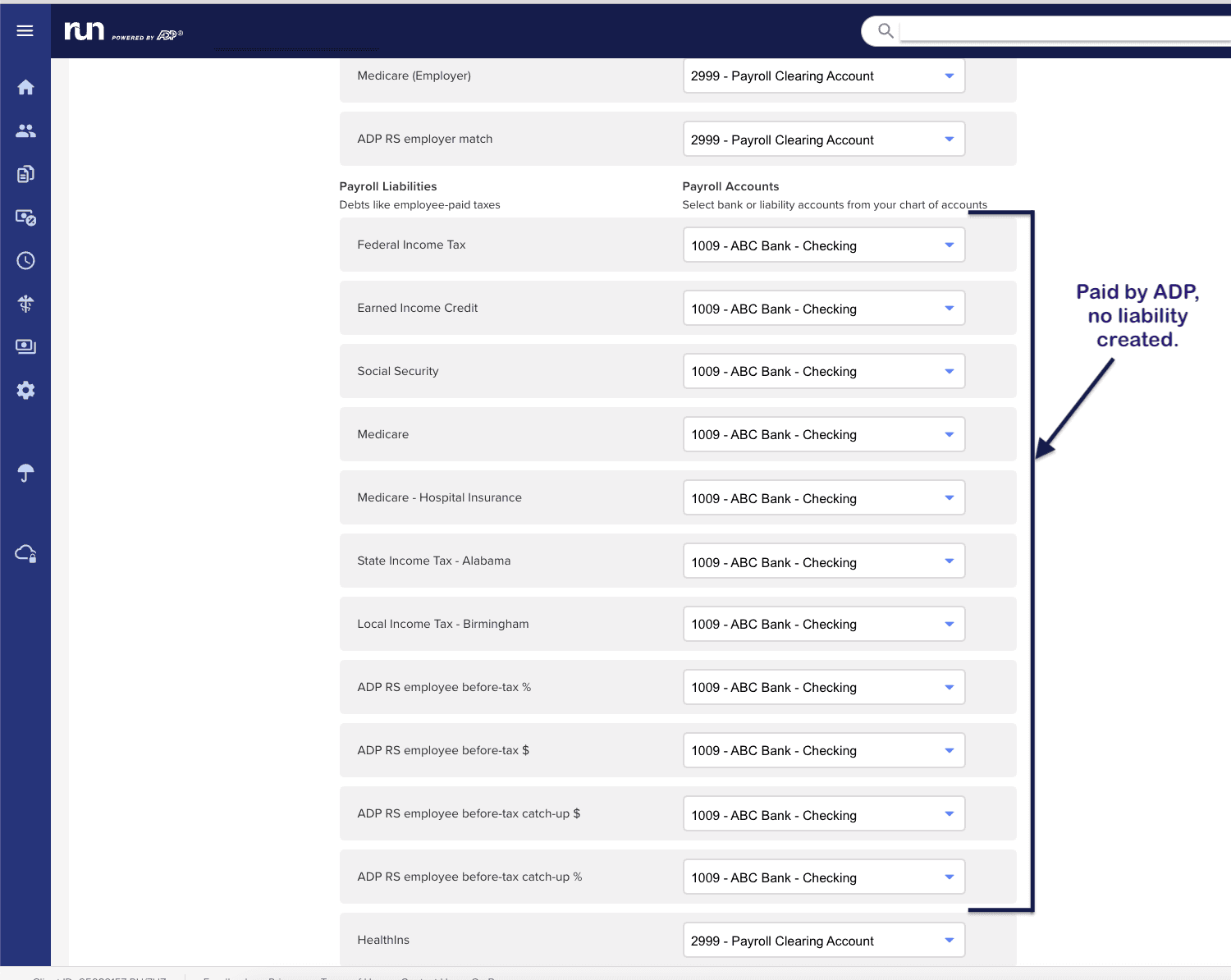

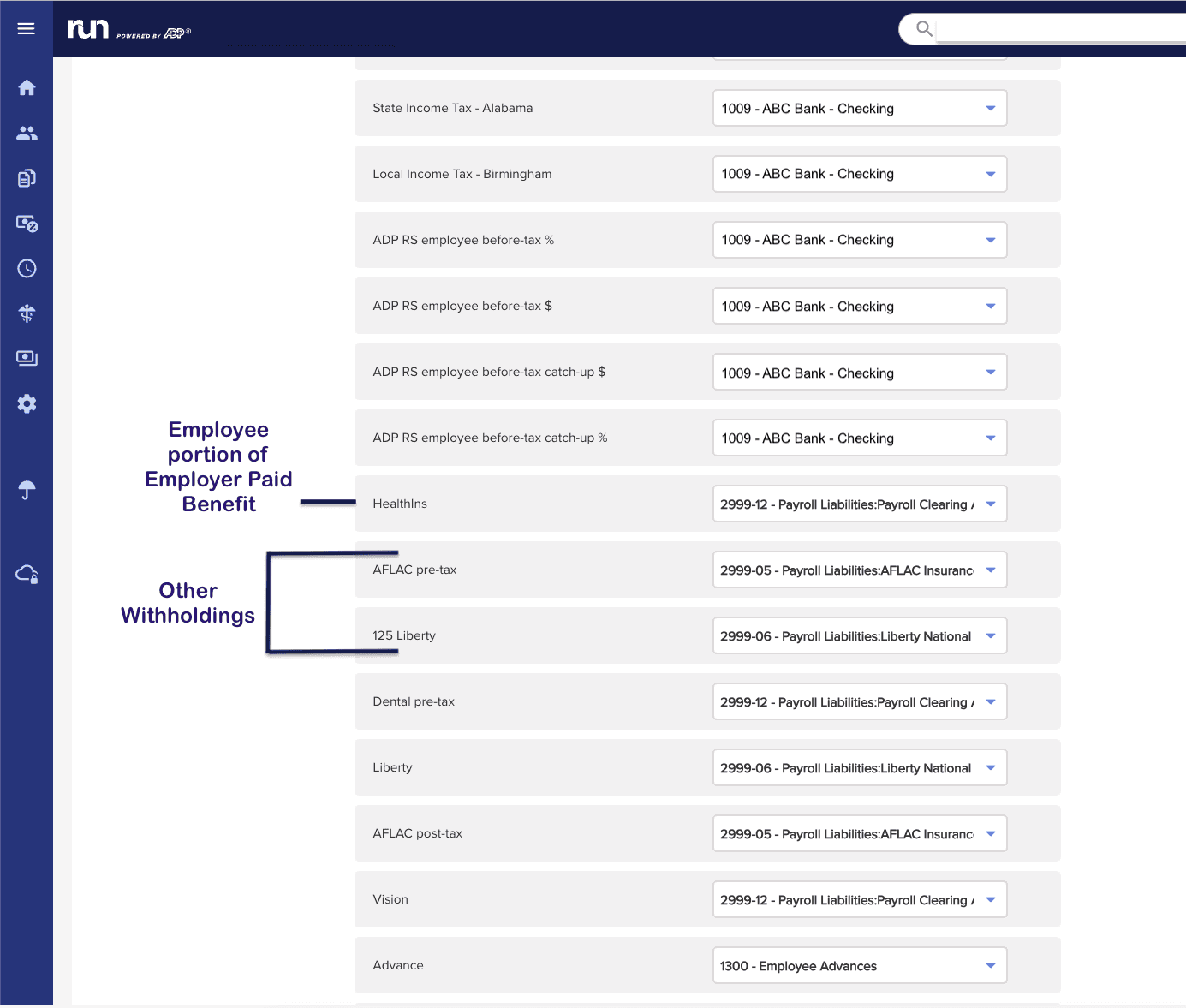

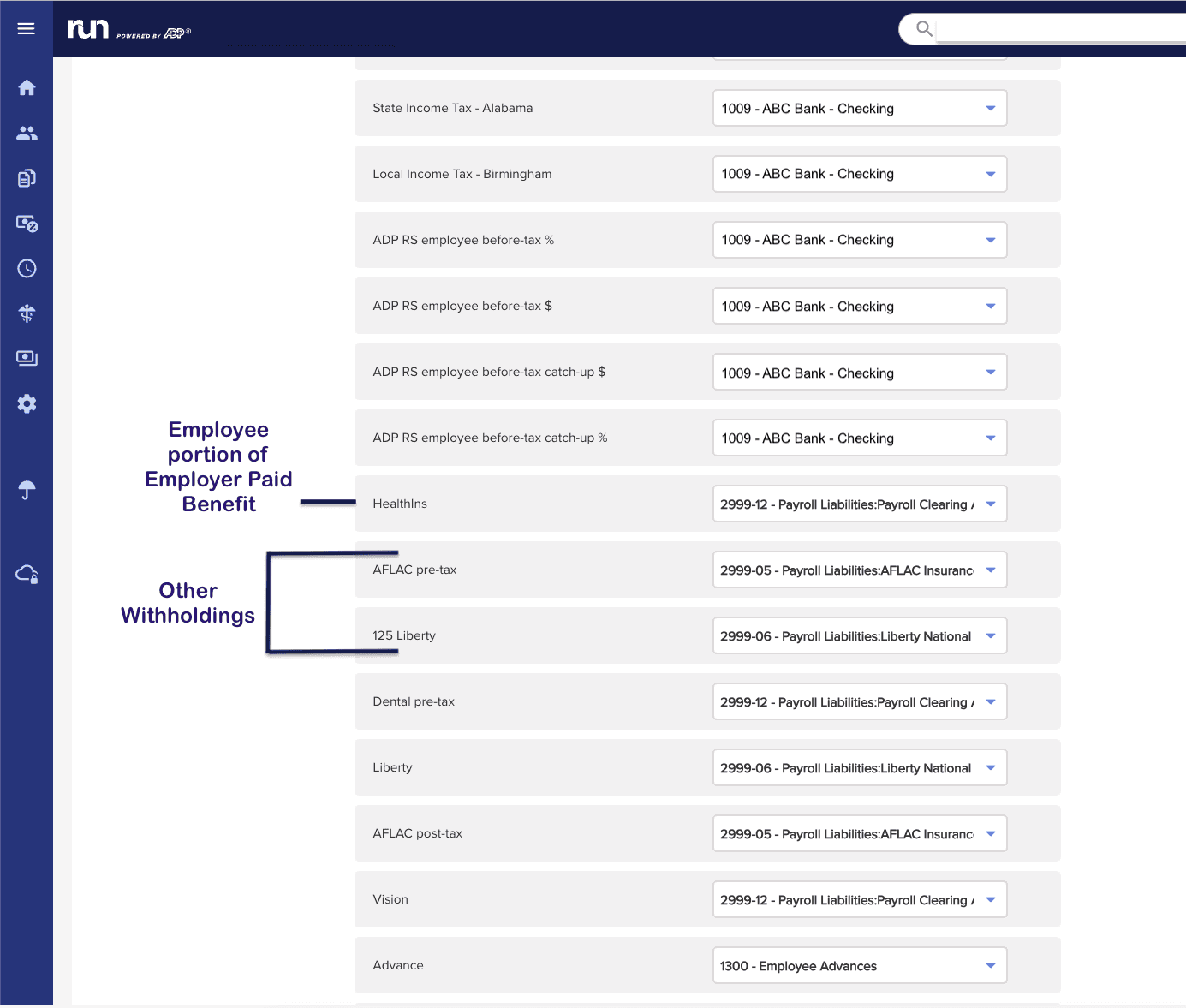

In the Payroll Liabilities section (credits)

Map any employee deductions for employee portions of fringe benefits to “Payroll Clearing Account”. (This might include health, dental, vision insurance, etc.)

Map other withholdings to appropriate liability accounts. (employee advances, garnishments not paid by ADP, other withholdings not paid by ADP, etc.)

For accounts where a liability is not needed (taxes, net pay, retirement paid by ADP, garnishments paid by ADP, etc.), map those items to the QBO checking account.

Each month, when running the allocation

Log into ADP Run

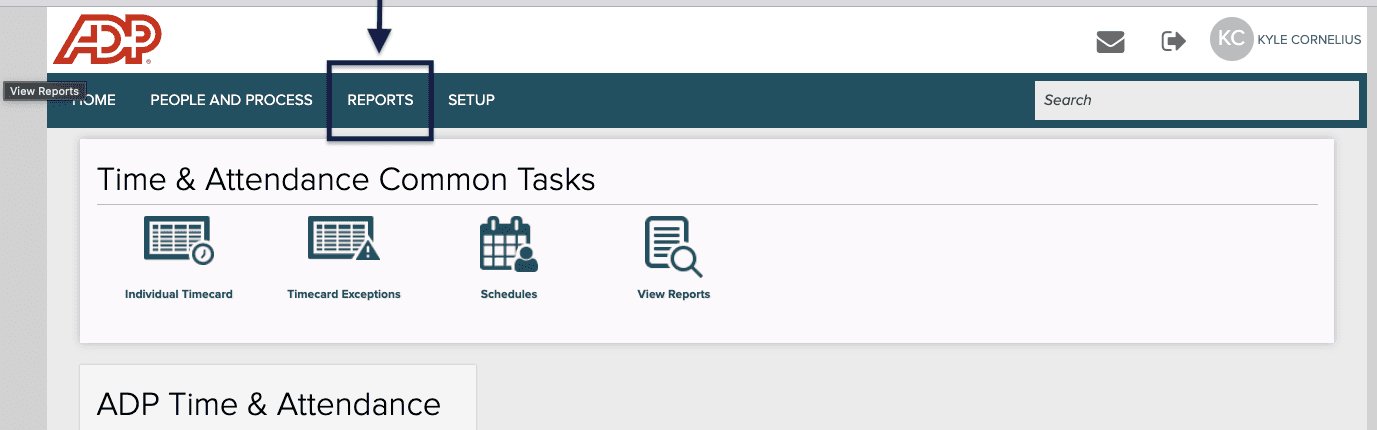

Download the Earnings Record report as excel file type. Edit date range to include all check dates during the month

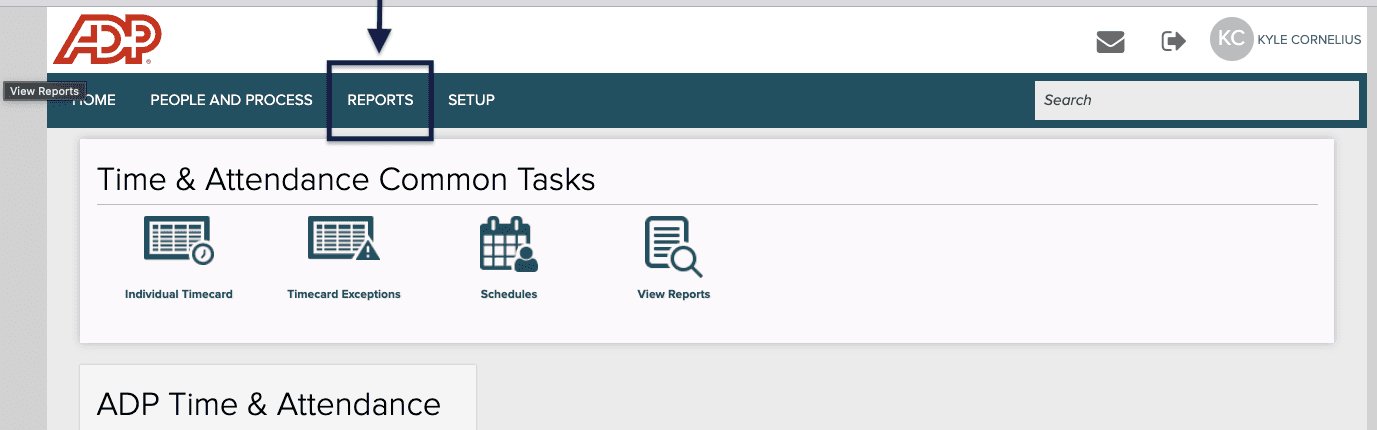

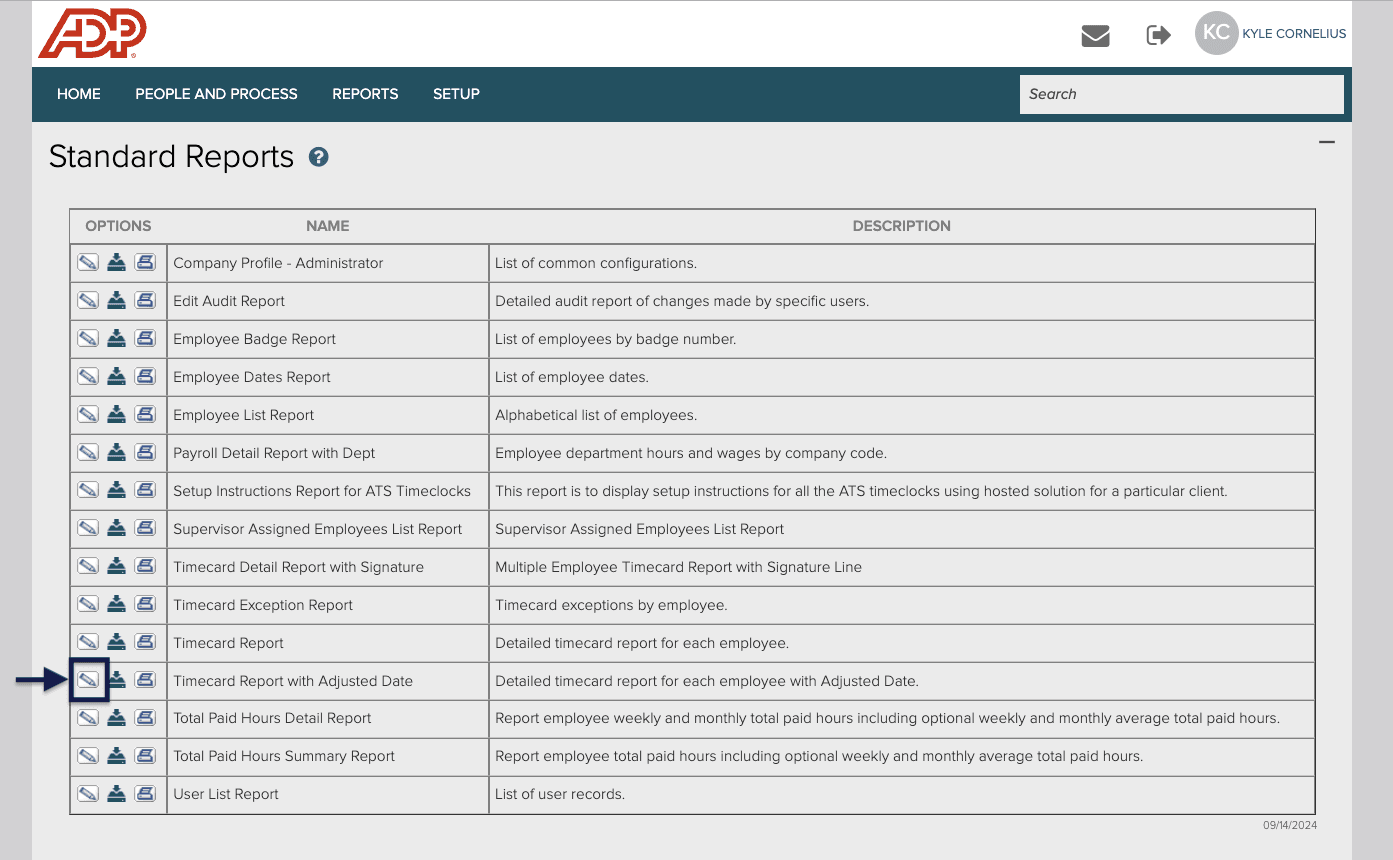

Download “Timecard Report with Adjusted Date” as csv. Edit date range to include the pay period beginning and ending dates for the check dates during the month.

2. Log into CAP

Create the pay period

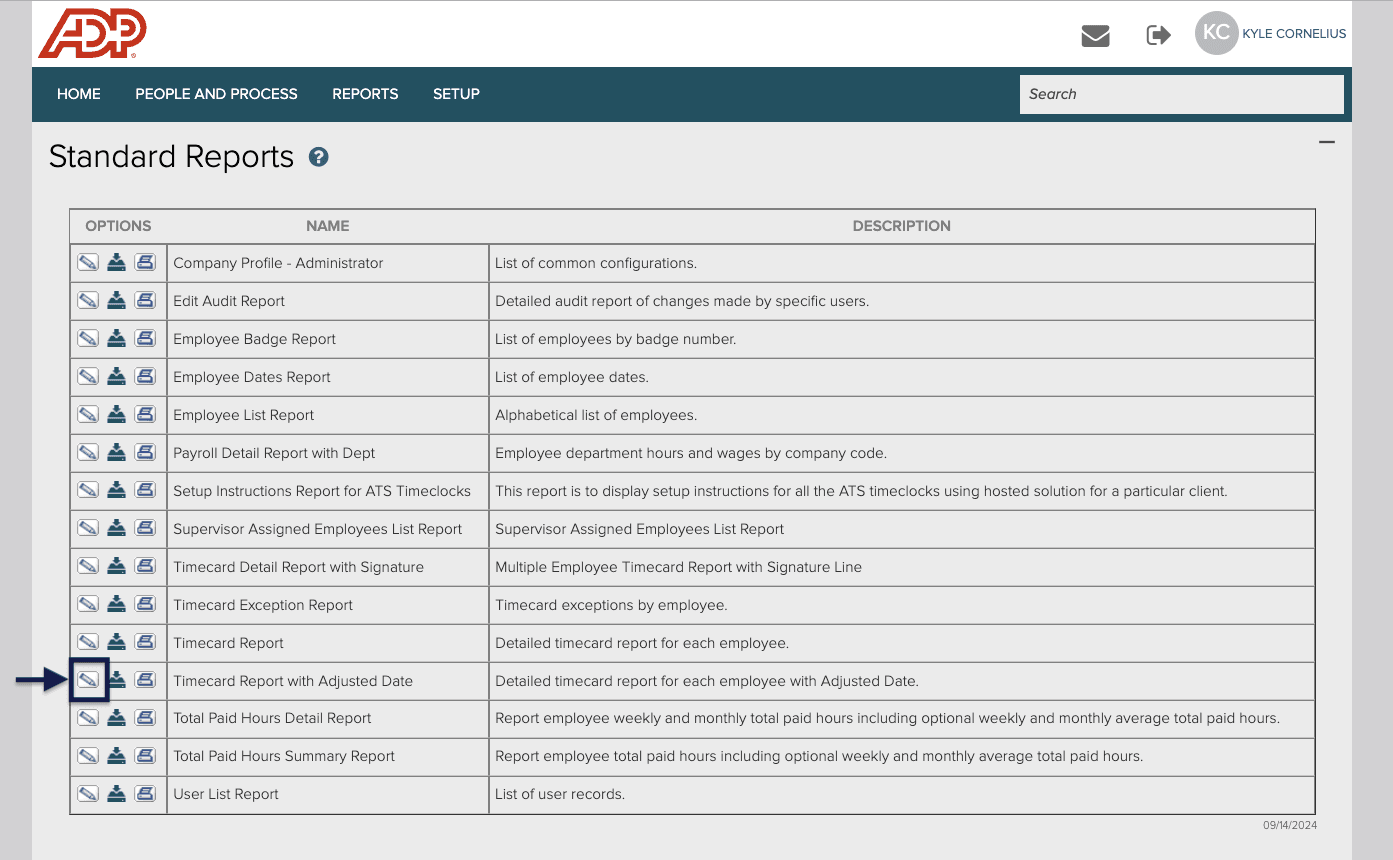

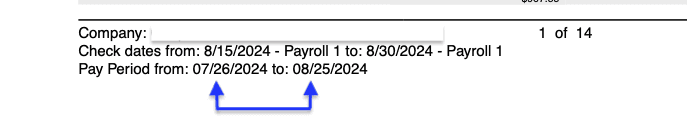

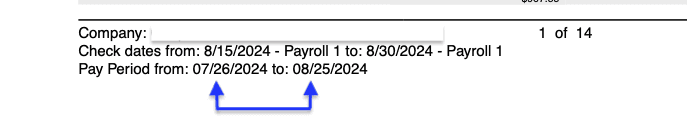

The pay period should match the beginning and ending dates of the payroll reports. See the image from an ADP Payroll Details report showing the pay period beginning and ending date.

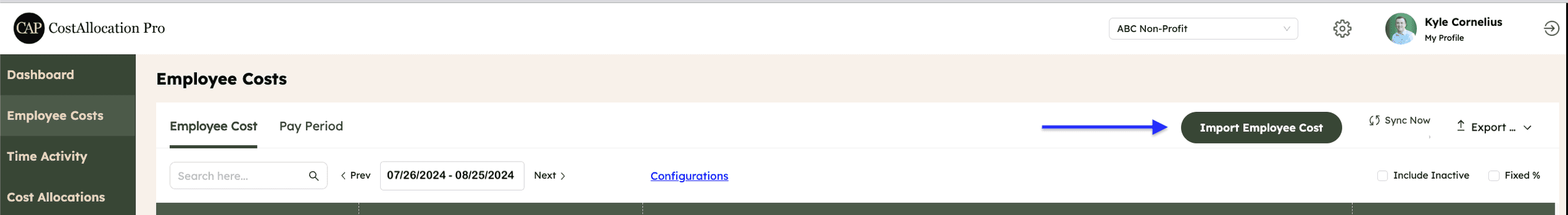

Upload employee costs. The ADP Earnings Record report provides the information needed. You may also have 3rd party paid fringe benefits that you will need to use the invoice from the 3rd party.

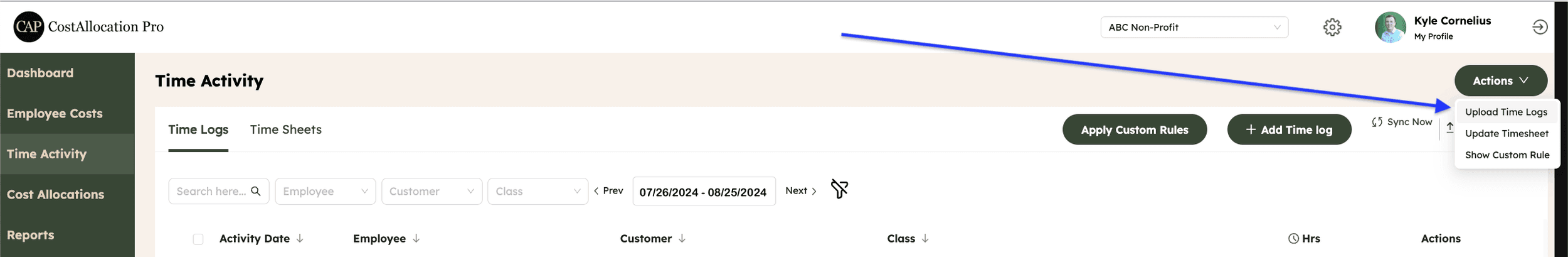

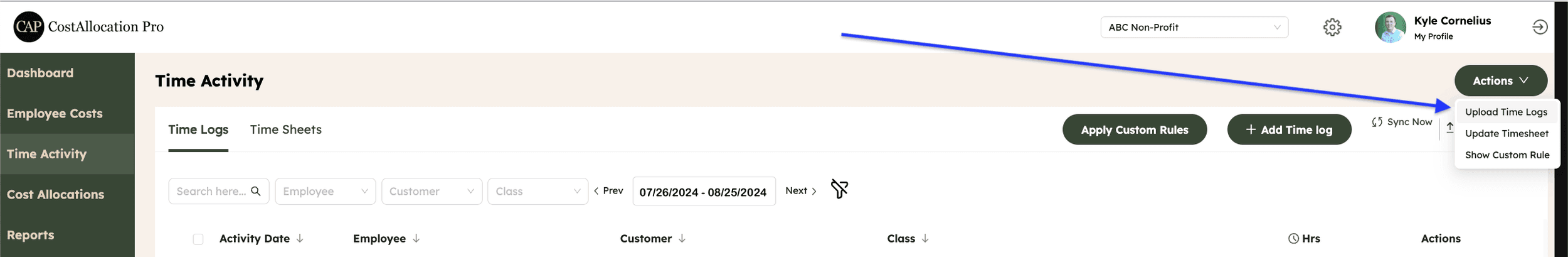

Use the ADP timecard report to upload the time logs to CAP.

Review time logs and apply Custom Time Rules (If applicable)

Create Timesheet

Review Cost Allocation

Publish journal entry into QBO

ADP Run + CostAllocation Pro

ADP Run + CostAllocation Pro can be a great combination to track and allocate payroll cost by customer/class. These instructions will provide guidance on setting up your ADP Run General Ledger to work best with CostAllocation Pro.

This workflow uses a Payroll Clearing Liability account. The Payroll Clearing Liability account will need to be added to your QBO chart of accounts if you do not already have that account set up.

To properly configure the ADP Run General Ledger:

Go to “General Ledger Setup” on ADP Run

On the “account mapping section” click the “Review” button for the “ Map Chart of Accounts for Company”.

The mapping fields are separated into two main sections, Payroll Expenses and Payroll Liabilities. The Payroll Expenses sections represents the debit side of the journal entries that will be posted by ADP. The Payroll Liabilities section represents the credit side of the payroll entries that will be posted by ADP.

Map all the Payroll Expenses (debits) to the “Payroll Clearing Account”

In the Payroll Liabilities section (credits)

Map any employee deductions for employee portions of fringe benefits to “Payroll Clearing Account”. (This might include health, dental, vision insurance, etc.)

Map other withholdings to appropriate liability accounts. (employee advances, garnishments not paid by ADP, other withholdings not paid by ADP, etc.)

For accounts where a liability is not needed (taxes, net pay, retirement paid by ADP, garnishments paid by ADP, etc.), map those items to the QBO checking account.

Each month, when running the allocation

Log into ADP Run

Download the Earnings Record report as excel file type. Edit date range to include all check dates during the month

Download “Timecard Report with Adjusted Date” as csv. Edit date range to include the pay period beginning and ending dates for the check dates during the month.

2. Log into CAP

Create the pay period

The pay period should match the beginning and ending dates of the payroll reports. See the image from an ADP Payroll Details report showing the pay period beginning and ending date.

Upload employee costs. The ADP Earnings Record report provides the information needed. You may also have 3rd party paid fringe benefits that you will need to use the invoice from the 3rd party.

Use the ADP timecard report to upload the time logs to CAP.

Review time logs and apply Custom Time Rules (If applicable)

Create Timesheet

Review Cost Allocation

Publish journal entry into QBO

More Update

Subscribe to our newsletter

Stay up to date on all of our latest updates and enhancements.

Subscribe to our newsletter

Stay up to date on all of our latest updates and enhancements.

Subscribe to our newsletter

Stay up to date on all of our latest updates and enhancements.